Although the 18 consumers do not wish to stop the transactions from taking place, they contend that they must be involved in order to guarantee that their interests are represented.

In order to guarantee that their interests are reflected, a group of FTX customers contends that they should be informed of the sale process before FTX’s proposal to sell four separately owned companies is implemented.

The organization has expressed worry over the possibility that “misappropriated client cash” were used to buy or maintain these businesses.

An ad hoc committee of non-U.S. consumers, consisting of 18 members, who have combined claims against FTX totaling more than $1.9 billion, submitted the limited objection on December 4.

The committee said in its petition that prior public declarations made by FTX, the Securities and Exchange Commission, and the Commodity Futures Trading Commission make it abundantly obvious that the client assets on the platform are owned by consumers, not FTX.

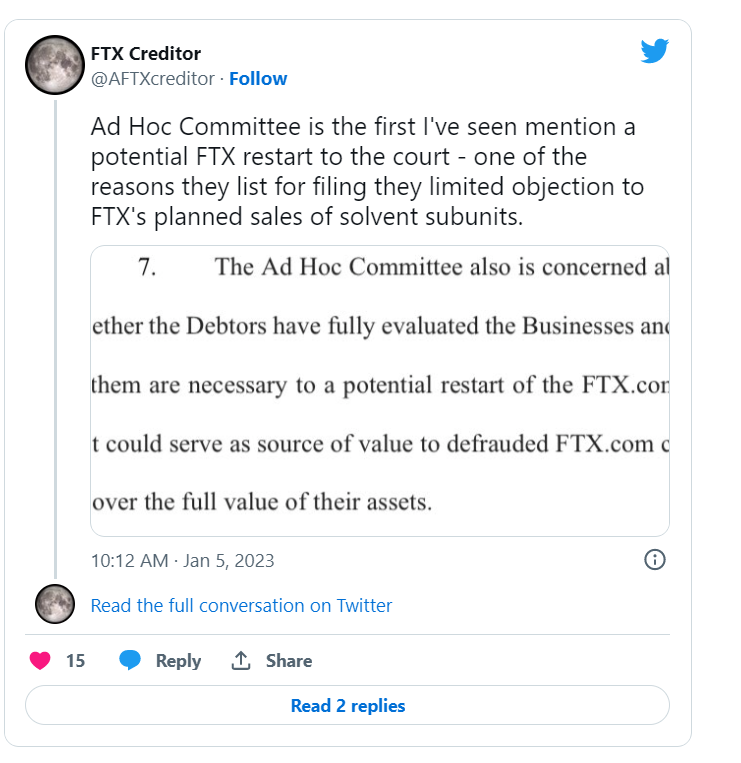

The absence of information on the sale of the firms, it claimed, had raised “serious concerns,” and it was also questioned if the businesses may be “essential to a prospective restart” of FTX.

Similar to an objection, a restricted objection simply pertains to a certain aspect of the proceedings. The limited objection in this case results from the ad hoc committee’s absence from the selling procedure.

In order to guarantee that consumers’ interests are reflected throughout the bidding process, the committee has requested that the judge grant them the right to act as “consulting experts,” adding:

The Ad Hoc Committee does not intend to obstruct the Debtors’ pursuit of value-maximizing transactions as long as the interests of FTX.com consumers are safeguarded.

The committee emphasizes that the consultation parties have no authority over the process other than the ability to give guidance, and that only consulting experts will be permitted to attend the auction and confer with FTX on issues relevant to the sale process.

On December 15, FTX requested permission from the bankruptcy court to sell its European and Japanese subsidiaries, as well as the derivatives exchange LedgerX and the stock-clearing platform Embed.

In particular, LedgerX has received praise for performing well during the bankruptcy proceedings. Rostin Behnam, chairman of the Commodity Futures Trading Commission, noted that the company had essentially been “walled off” from other businesses within the FTX Group and “held more cash than all the other FTX debtor entities combined.”

The same committee requested last week that the names and private information of consumers be removed from court records, claiming that doing so might expose customers to identity theft, targeted attacks, and “other damage.”

A source: https://cointelegraph.com/